Summary of landlord lease return loan conditions and actual reviews Summary of landlord lease return loan conditions and actual reviews Summary of landlord lease return loan conditions and actual reviews

hello. Today, I would like to talk about raising funds to return the lease, which many landlords (landlords) are concerned about. Although the rental deposit must be returned to the tenant on time, there are many times when a lump sum of money is needed all at once. If it is a new building, some funds are required during the completion process, and even if it is an existing building, cash flow may be difficult due to reasons such as maintenance and repairs or investment. The product that can be used in this situation is **Landlord Lease Return Loan (Lease Return Loan)**. In the past, homeowners themselves had to look into personal loans, but now many banks and financial institutions offer separate products for the purpose of returning deposits.

▼▼▼ Click here for loan success reviews and information ▼▼▼

〖The day when debt becomes light〗Credit loan / mortgage loan: Naver Cafe〖Debt, light, day〗The day when debt becomes light // Credit loan / Mortgage loan // Information community cafe.naver.com

I, too, had a situation where the tenant’s contract period was coming to an end, and funds were suddenly tied up elsewhere, making it difficult to return the deposit. In the end, after carefully comparing the conditions of several banks, I was able to secure funds through a landlord jeonse return loan and smoothly return the jeonse deposit. From now on, I will tell you step by step the conditions of the lease return loan that I have personally experienced, the documents to prepare, precautions for each bank, and how customer debt and information are verified. 1. What is a landlord lease return loan?

Conceptual landlord jeonse return loan (lease return loan) refers to a loan received by a landlord to return the jeonse deposit to the tenant. People who are in the real estate rental business or general landlords who suddenly have difficulty raising a lump sum can also use it. Main purpose: The biggest purpose is when the tenant wants to move out at the end or renewal of the lease contract, when the landlord wants to move out. In a situation where the deposit must be returned to the owner, the funds are secured through a loan. I had previously looked into various loan products, but since I had a specific purpose of ‘returning the deposit’, I looked for a landlord deposit return loan product that met the conditions better. It is done.

2. Why did you use the landlord jeonse return loan?

When I needed funds urgently. The lease period ended and the tenant moved out. At this time, I also had funds already tied up for house repairs and other investment purposes. Since I did not have enough spare money to return the loan in earnest, I naturally needed a loan. Loans for the return of deposits with relatively favorable loan conditions often have lower interest rates than general credit loans or have a higher limit depending on the collateral (house). The bank I was dealing with also explained a jeonse return loan product that landlords could apply for directly, so I decided that would be much more advantageous. Minimizing credit problems for landlords “I have rental income through real estate rental business, and the purpose is to return the jeonse deposit.” If it is clear, even commercial banks view the risk as relatively low. As a homeowner, if you can prove that you have collateral (real estate value) above a certain level, you have the advantage of being able to go through a loan review relatively smoothly, as long as your credit rating is not completely low.

3. Comparison of conditions by bank

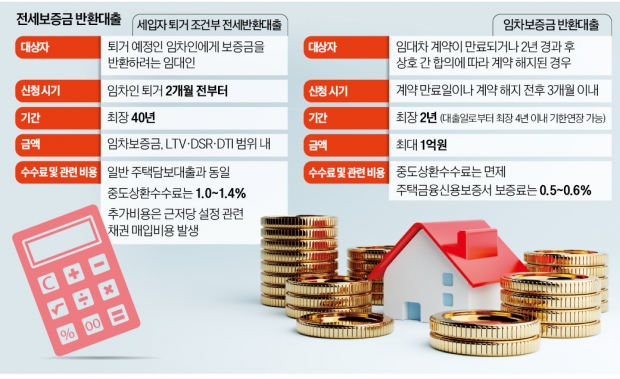

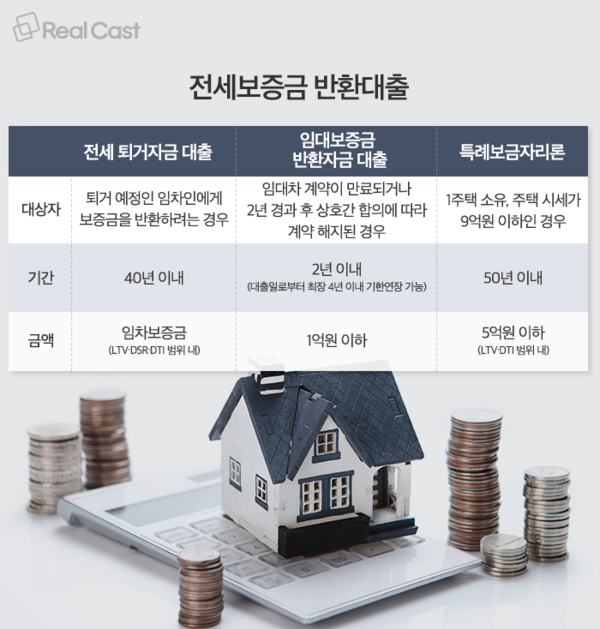

The basic framework of landlord jeonse return loan products is similar for each bank, but there are differences in detailed conditions. Typically, interest rates, limits, repayment methods, and early repayment fees are slightly different. Here’s a summary of the common elements and differences among what I’ve found: Loan limit: In most cases, loans are available up to 70-90% of the rental deposit. However, the limit may vary depending on whether you already have another mortgage or the loan ratio (collateral recognition ratio, LTV) to the housing market price. In my case, the apartment market price was about 500 million won, and the tenant’s deposit was 200 million won. In the end, I was informed that I could borrow up to around 150 million won. The interest rate was slightly different for each bank, but it was usually around the mid to high 3% to low 5% per annum range (at the time I looked into it) Standard). You can choose between a floating interest rate or a fixed interest rate, and preferential interest rates (preferential rates for home transactions, preferential automatic transfers, etc.) may apply even within the same bank, so you must carefully consider them.

Repayment methodPrincipal installment repayment: A method of repaying the principal and interest in installments during the loan period. Lump sum repayment at maturity: Paying only the interest every month and repaying the principal all at once at the time of maturity. Selected products are usually set for 1 to 3 years, if necessary. Extension was also possible. After returning the deposit for early repayment fee, it was possible to repay it quickly due to the sale of real estate, etc., so products with low or no early repayment fee were selected. I preferred it. The ratio varied from 0.5% to 1.2% for each bank, and some products had promotions where fees were gradually reduced or exempted depending on the period.4. Customer Debt and Information Collection Method When reviewing a loan, banks generally check the homeowner’s credit rating, income, and existing debt. Specifically: Personal Credit Rating System (CSS) inquiry: Determination of delinquency history, card use, existing loan situation Measurement of debt ratio (DSR, DTI, etc.): By adding up employment status (earned income), business income, rental income, etc. Assessing Debt Repayment Ability I reported some real estate rental income, and I didn’t have many other loans, so the review process wasn’t that big. However, we have prepared in advance the rental income-related income amount certificate (issued by the National Tax Service).

5. Documents to prepare (based on landlord) The following is a list of documents I submitted to the bank. Requirements may be slightly different for each bank, but they are generally similar. ID: Resident registration card or driver’s license copy (building registration certificate): Proves that you are the owner of the building and confirms that the rights are clear Copy of resident registration: Actual residence Verify your identity information. Copy of rental agreement (contract with tenant): You must show that the contract has been properly concluded, and the confirmed date is often written. Proof of income: Documents proving the existence of a rental deposit, such as business registration (if you are a rental business), proof of income, proof of employment (if you have earned income), withholding tax receipt, etc.: Documents confirming the real estate market price required to confirm the amount of the rental deposit, contract period, etc. : There are quite a few things to prepare, such as KB market prices and appraisal reports (which can be done by the bank itself), but it was easy to prepare the documents because I received a checklist in advance. If you come to the bank with everything at once, the screening process tends to go faster.

▼▼▼ Click here for loan success reviews and information ▼▼▼

〖The day when debt becomes light〗Credit loan / mortgage loan: Naver Cafe〖Debt, light, day〗The day when debt becomes light // Credit loan / Mortgage loan // Information community cafe.naver.com

6. I will briefly summarize the loan process & actual review process in order: Before making a bank consultation reservation, I called my main bank and asked, “Do you have a homeowner rental return loan product?” and was informed of the type and approximate conditions. I made an appointment to visit the back branch. On the day of document submission and pre-screening reservation, I submitted all of the prepared documents to the counselor. According to the bank’s internal screening process, the person in charge roughly calculated the loan availability, limit, and interest rate. The results of the main screening and pre-approval screening were positive, so it took about 3 to 5 days to proceed with the main screening. During the process, I was contacted if any additional documents were required, and I submitted the rental income certificate again. Afterwards, I received a final approval notification, and the interest rate, limit, and repayment conditions were confirmed. After signing the agreement and approving the loan execution. I visited the bank again, signed the loan agreement, and submitted all documents. The loan amount was deposited into the account I designated, and the funds were immediately returned to the tenant as a deposit for rent. From the tenant’s perspective, I was able to complete the contract neatly because the deposit was made on time. The biggest thing I felt after using it was that I felt financially at ease. I was able to maintain a good relationship with the tenant. If I sell the property in the future or receive a large amount of money in another situation, I can repay the loan in a lump sum. At that time, I paid particular attention to the early repayment fee. Fortunately, the product I chose was available for a certain period of time. The fee was waived once the fee was passed, so it was less burdensome.

7. Precautions and Tips Check if there are other mortgage loans If you already have a loan collateralized by the house in question, you should check the loan priority (senior/subordinate). Loan limits can vary greatly, so consult with a bank representative in advance. It is a good idea to do enough. Check the early repayment fee. You may repay the loan sooner than you think after returning the deposit, so be sure to ask how much the early repayment fee is. Depending on the product, the fee may be reduced by period or not at all. In some cases, there is no extension policy. Landlord lease return loans are often initially set for 1 to 3 years, but the interest rate or limit may change when extended, so it is good to know this in advance. Pay attention to income and credit management. Even if you are a landlord, you may have difficulty getting a loan approved if your credit rating is too low or you have a history of delinquent payments. Manage rental income reports and credit card delinquencies on a regular basis to ensure smooth loan processing. It’s a good idea to prepare. Comparing multiple banks Don’t just look at one bank, but compare at least 2 to 3 banks that seem to have good terms. The key is to comprehensively review interest rates, fees, loan periods, etc. to find the most advantageous conditions. 8. In conclusion, the landlord lease return loan is a very useful financial product when the landlord needs to quickly return the lease deposit to the tenant. From my actual experience, as long as income or credit rating is not a major issue, the process is not as difficult as I thought. Of course, it takes some time to prepare documents or review the bank, but if you plan ahead and do your research, you can get a loan without much difficulty. The most important thing is to maintain a good relationship with the tenant and facilitate the flow of funds. If the tenant is suddenly told, “We cannot return the deposit,” at the end of the lease contract, anxiety will inevitably increase for the tenant. In that respect, the landlord jeonse return loan can be said to be a win-win option for both parties. Lastly, to summarize a few tips I would like to give you, make sure to check **“early repayment fee”**.

Previous imageNext image

Let’s report taxes carefully so that we can prove rental income. Let’s accurately understand the priority relationship with other mortgage loans. Let’s compare products from at least 2 to 3 banks and choose the optimal interest rate and terms. This is the end of the landlord jeonse return loan. I would like to conclude my actual review and story about conditions. I hope this will be of some help to those like me who are having trouble managing their funds when returning their deposit, and we will continue to share useful information about real estate rental and finance in the future. If you have any questions, please feel free to leave a comment. Thank you! Summary of landlord lease return loan conditions and actual reviews Summary of landlord lease return loan conditions and actual reviews Summary of landlord lease return loan conditions and actual reviews Summary of landlord lease return loan conditions and actual reviews